FHA Mortgages

FHA mortgage loans contain many additional benefits and protections that can’t be obtained through other home loan programs. FHA mortgage loan requirements aren’t completely driven by a borrowers credit score, though they will usually need at least a 620 middle FICO score to get approved through most lenders. While FHA mortgage guidelines are more flexible than other home loan programs, there are still basic requirements that must be met.

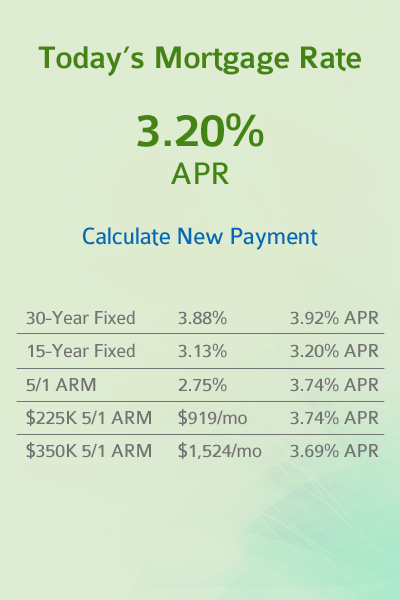

FHA Mortgage interest rates are usually better than other comparable loan programs and they carry low mortgage insurance costs to the borrower. FHA mortgages have a low 3.5% down payment requirement and it is possible for the money to be gifted from a family member, employer or charitable organization.

To be eligible FHA Mortgage approval, your monthly housing costs (mortgage principal and interest, property taxes, and insurance) must be less than a specified percentage of your gross monthly income (31% ratio). You must also have enough income to pay your housing costs plus all of your additional monthly debt (43% ratio). These ratios can be exceeded somewhat with compensating factors like a high credit score. Your credit background will be looked at carefully. Generally speaking, a 620 middle FICO credit score or higher is required for approval.